When Criminal Checks Aren’t Enough The SMB Guide to Verifying Real Skills and Real People

Resume fraud is rising—especially for small and mid-sized employers. You already run criminal checks, but that only answers one question: “Is this person a risk to people or property?” It doesn’t answer the question costing SMBs the most in going into 2026: Is this person who they say they are—and can they actually do the work? For a practical path forward, pair your FCRA-compliant employment background checks with simple verification add-ons that confirm identity, credentials, and capability.

Quick Summary

- StandOut CV’s U.S. study found ~64% admit to lying on a resume.

- Resume.org reports 6 in 10 resume fraudsters still got a job offer in 2024—and most say they weren’t caught.

- Criminal checks are necessary, but verifications (employment, education, references) stop “ghost candidates.”

What Exactly Is a “Ghost Candidate”?

We’re not talking about candidates who stop replying. A “ghost candidate” is a paper-only persona: polished resume, confident interview, weak or fake substance. Think three flavors:

- The Exaggerator: stretches dates, inflates titles, pads team size.

- The Fabricator: claims degrees never earned or lists employers that don’t exist.

- The Identity Thief: uses another person’s identity or a proxy in remote interviews—an issue managers now openly report.

AI makes this easier. Candidates can generate keyword-perfect resumes and even use proxies for technical interviews. In a recent 2025 hiring manager survey, employers highlighted that AI-enabled identity misrepresentation and proxy interviews are creating real financial losses for employers.

Takeaway: A clean criminal check doesn’t mean the person—or their claims—are real.

Why Small Businesses Are the #1 Target

Fraudsters assume smaller teams rely on gut feel and instant, database-only checks. They’re betting you’ll skip the “extra” steps that confirm identity and capability.

- Lean HR bandwidth and pressure to fill roles fast.

- Overreliance on cheap instant checks that miss context and accuracy.

- Limited process maturity compared to enterprise compliance programs.

Industry guidance from the Professional Background Screening Association (PBSA) emphasizes multi-source screening and targeted verifications—exactly the tools that catch fabricated histories and sham employers.

Takeaway: SMBs aren’t defenseless—just pick the handful of verifications that matter for the role.

The Hidden Cost of a Bad Hire (Beyond the Salary)

The U.S. Department of Labor estimate, frequently cited by SHRM, puts the cost of a bad hire at up to 30% of first-year earnings—and more for managers (SHRM reference).

- Training waste: onboarding time you can’t get back.

- Morale damage: good employees carry the load.

- Client risk: missed deadlines, do-overs, and reputation hits.

Takeaway: Paying a few dollars for verifications is cheaper than paying months of cleanup.

Verification vs. Criminal Checks: Know the Difference

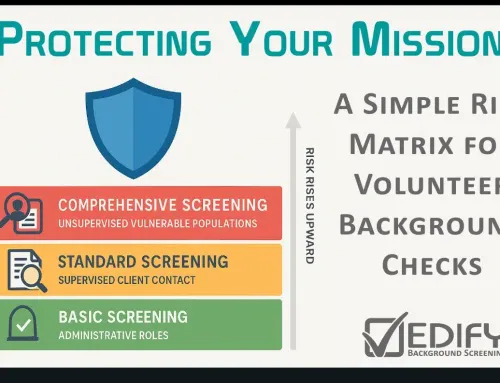

Criminal checks search records for reportable offenses. They are necessary, but they do not confirm identity, experience, or credentials.

Verifications are your “ghost busters” that validate claims:

- Employment verification: confirm titles, dates, and scope. Did they really lead a team of 20, or were they an intern?

- Education verification: registrar-level confirmation to shut down diploma mills and “almost finished” degrees.

- License and Certification verification: confirm licenses and/or certifications were indeed earned and current.

- Reference checks: structured, professional references that speak to actual performance (not a best friend with a Gmail address).

Authoritative bodies like PBSA publish practical guidance on verifications and fraud trends, including fraudulent employers. Build these steps into your standard package so they’re not skipped when hiring gets busy.

Takeaway: Run criminal checks for safety; add verifications for truth.

3 Red Flags You Can Spot Today (Pro Tips)

- “Defunct” employer pattern: Multiple past companies that conveniently “shut down” or have no online footprint.

- Date stretching: Only years listed (e.g., “2022–2024”) instead of months can hide multi-month gaps.

- Generic references: Free email domains, vague titles, or reluctance to speak live.

Takeaway: If it looks hard to verify, that’s your signal to verify.

Proof It’s Happening: 2024–2025 Data

- StandOut CV: More than 3 in 5 U.S. job seekers (64.2%) have lied on a resume (source).

- Resume.org: 6 in 10 resume fraudsters received a job offer in 2024, and 96% say employers never discovered the lie (study; press summary).

- AI & identity fraud: Managers report proxy interviews and fake identities driving real losses; many are now updating protocols.

Takeaway: The numbers say fraud is common—and often undetected without verification.

How EDIFY Helps You Bust Ghosts Without a Fortune 500 Budget

You don’t need enterprise spend to get enterprise certainty. EDIFY bundles targeted verifications with FCRA-compliant screening so you can confirm truths that matter before day one.

- Right-size packages for SMBs and nonprofits.

- Employment, education, and reference verifications as simple add-ons.

- Clear timelines and communication if sources are slow.

Start with a lightweight package and add the one or two verifications that make the biggest difference for your role. See options for small business background checks, or keep it broad with general business background checks.

Takeaway: A few precise checks beat a pile of guesses.

Conclusion & Next Steps

Trust is good. Verification protects your margins. If you’re seeing polished resumes and rushed timelines, add identity and credential truth-tests before you send the offer. So if you’re worried about your current applicant pool? Add a Verifications to your background check program stack today.

See our background check pricing.

FAQ

Q: Do I still need criminal checks if I add verifications?

A: Yes. Criminal checks address safety and legal exposure. Verifications address truth. You need both to reduce risk. Next step: pair your criminal search with at least one verification for critical roles.

Q: How long do employment or education verifications take?

A: Most complete within a few business days depending on source responsiveness. Build them into your standard offer timeline so hiring doesn’t stall.

Q: What’s the best first add-on for SMBs?

A: If your hires claim specific credentials, start with Education Verification. For roles with big responsibility or client contact, add Employment Verification to confirm seniority and scope. See options on our services pages above.

Q: Is this FCRA-compliant?

A: Yes, when ordered through a CRA and used with proper disclosures, authorization, and adverse action procedures. See the FTC’s FCRA statute and PBSA resources below for authoritative guidance.

Compliance Note

- Provide standalone FCRA Disclosure & Authorization before ordering a report.

- Use the pre-adverse and final adverse action steps if a decision may be impacted by report findings.

- Confirm criminal hits at the source and consider job relevance and applicable laws before making decisions.

Authoritative Sources

References:

StandOut CV resume lying study ·

Resume.org 2024 fraudster outcomes ·

SHRM on DOL “30%” estimate ·

TechRadar on Checkr 2025 manager survey ·

Checkr: Hiring Hoax survey article ·

PBSA practical guidance

Internal links inserted: [FCRA-compliant employment background checks → https://www.edifyscreening.com/general_business_background_checks/]; [small business background checks → https://www.edifyscreening.com/small_business_background_checks/]; [general business background checks → https://www.edifyscreening.com/general_business_background_checks/]; [See our background check pricing → https://www.edifyscreening.com/background_check_pricing/]